While you don’t officially need it to operate, there are several benefits of having an EIN (employer identification number) for your handmade skincare business.

From financial security to future endeavors, having an EIN at the very beginning of your entrepreneurial journey is a smart move.

In this article, we’ll discuss the facts behind employer identification numbers, why you would want one, and what to do once you have one for your skin care business.

This post may contain affiliate links, meaning I get a commission if you decide to make a purchase through my links (at no cost to you). Please read the disclosure for more information.

What is an EIN (Employer Identification Number?)

An EIN (employer identification number) is a nine-digit number assigned by the IRS (United States federal government) to identify you, your business accounts, your tax returns, and other related documents.

In layman’s terms, it’s basically a social security number for your business.

Does Your Skin Care Business Need an EIN?

Most handmade skin care businesses are run by one individual as a sole proprietor or single-member LLC.

If this is you, you do not technically need an EIN (yet).

However, if any of the following are true (or might be true in the future), you will need to get an EIN for tax purposes:

- If you have employees

- If you are taxed as a corporation

- If you are a multi-member LLC

- If you bought your business from another individual

The IRS EIN questionnaire is here if you’d like to double-check to see if you need one.

I urge you to keep reading, as there are many benefits to having an EIN for your skin care business even if you don’t officially need one.

Benefits of Having an EIN (Even if it isn’t Required)

1. An EIN helps to prevent identity theft.

On all e-commerce marketplaces or website builders, you are required to provide either your social security number or employer identification number to get set up.

Currently, fraud occurs much less with EINs on the off-chance should any of these sites be compromised. Consumer fraud with SSNs is somewhat common, whereas EIN fraud is not.

2. An EIN makes tax deductions easier.

As most skin care businesses are home-based, we have a good chance of having a list of deductions to submit during tax time (office square footage, internet bills, vehicle use for post office trips, etc.).

You are more likely to receive a small business IRS audit if you submit business taxes and deductions under a social security number (versus an employee identification number).

3. Often need an EIN to get a business banking account.

Not all, but many banks require an EIN to open a business banking account.

You will want a separate bank account for your skin care business to both simplify your bookkeeping and also to limit liability in the case of a lawsuit.

My article on LLCs and skin care businesses covers the liability aspect in more depth, but for our purposes here, know that most banks require an EIN for checking or savings business accounts.

4. An EIN helps you to build business credit.

I’m a big fan of NOT putting yourself in debt to build your business. One of the perks of our industry is that we can start slowly and build without needing a ton of funding or supplies.

However, building your business credit to get that positive financial history for future opportunities is also smart.

You can begin this process slowly by applying to PayPal for Business account, and then branching out to larger things like business credit cards.

Starting this financial growth plan at the beginning will help you to be ready for other business opportunities when they arise.

5. Having an EIN helps speed the process of business loan applications.

Once you grow your business and your trustworthiness (as well as your credit discussed above), you may find yourself in need of a business loan to get a large-scale project off the ground:

- Perhaps a brick-and-mortar shop?

- A game-changing ad campaign?

- A large-scale equipment purchase?

While I again urge you to consider growing in a way that does not put you in debt, there can be financial benefits to considering a business loan.

Having an EIN for your business results in fewer steps in the loan process and speeds up the wait time for you overall.

6. An EIN is required to have employees.

Thinking into the future of your skin care business, keep in mind that an EIN is required to set up a payroll system.

It is also worth mentioning that while not required, providing an EIN in lieu of your SSN to vendors and other freelance workers for one-time help (such as graphic design, editing, etc.) makes you look more professional, as well as keeps your personal finances safe…which brings us back around to point number one!

Things to Do Before Applying for Your EIN

The process of obtaining an EIN itself is very (very) simple, but there are a few things to consider before submitting your application.

Name Your Skin Care Business

Your EIN will be under your business name, so you’ll want to take the time to develop a slam-dunk name for your skin care business.

You will benefit greatly from taking the time to do target market research, play around with naming strategies, consider helpful taglines, and check for the availability of your desired business name.

Form an LLC for your Skin Care Business

As a skin care maker, I highly recommend forming an LLC for your skin care business.

This is also not required, but strongly suggested to protect your personal assets – creating skin care products to sell to others does not come without risks.

You can easily set up an LLC on your own (much more affordable than having someone do it for you), but prepare yourself for several action items.

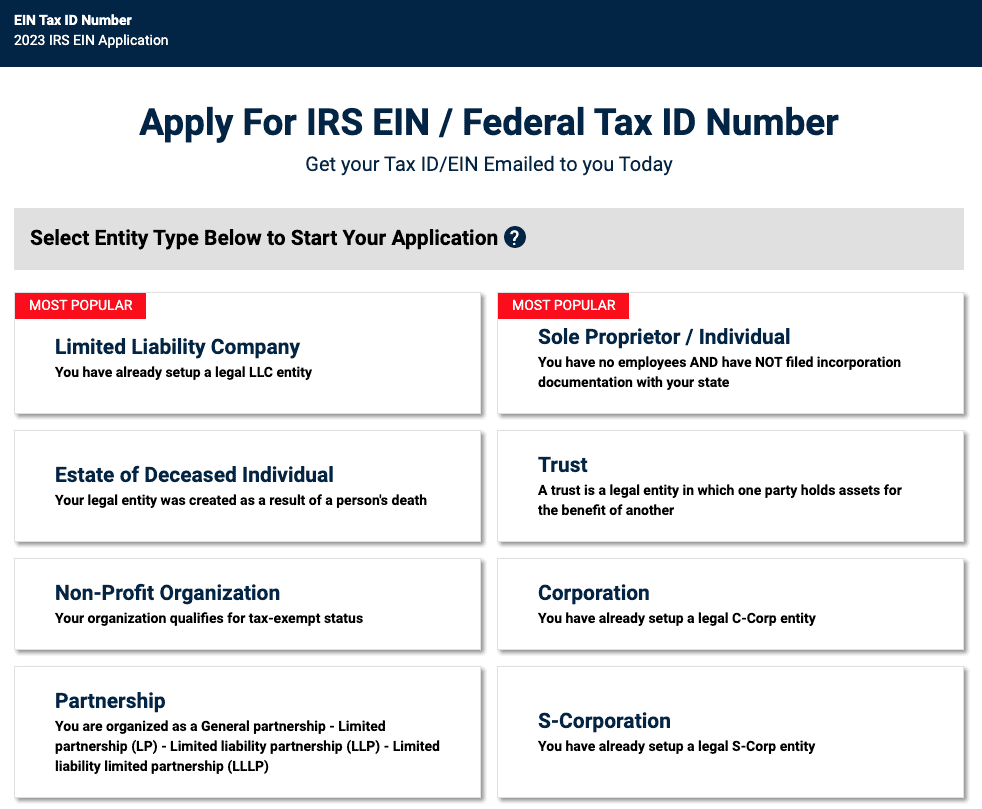

How to Get an EIN for Your Skin Care Business

After naming your skin care business and completing the optional LLC setup, you’re ready to grab your EIN.

Simply go here to complete the EIN application.

This is a one-page application that should take no more than 5 minutes to complete and your EIN is emailed to you directly afterward (free of charge).

Next Steps After Receiving Your EIN

Save to Permanent Records

After you are emailed your EIN, make sure you print it out and also keep a digital copy for your permanent records (the IRS will not send you another copy).

Switch out Your SSN with Your EIN

If you have already set up websites or payment processors for your skin care business such as Etsy, Shopify, PayPal, Stripe, etc. and used your social security number, go back to those sites and replace your SSN with the new EIN.

Start Building Your Business Credit

Using your new EIN, apply for a Paypal business account, business checking account, and/or a business credit card.

I have had a great experience with American Express (Blue Business Plus) credit card – a $0 annual fee card with points earned with each purchase.

Prepare for Taxes

Now that you’re on a roll with all these fancy behind-the-scenes business to-dos, keep going by familiarizing yourself with the education and resources available at Paper + Spark.

Janet (the owner of Paper + Spark) is a CPA who specializes in helping small, handmade businesses with all things inventory, bookkeeping, and taxes.

She makes it all super easy to understand and is a wealth of knowledge (with a strong support team to answer any questions you have).

Connect with Other Skin Care Makers

If you have any questions about getting an EIN for your skin care business, please head over to our private FB Group (just for skin care entrepreneurs) and ask away!

All my best to you as you take this huge, exciting step for your business!

Grow Your Skin Care Business!

Browse through the resources below to boost your handmade business visibility and profitability!